ICYMI: Eat, Sleep, Spend—FY2023 Deficit Adds Trillions to the Debt

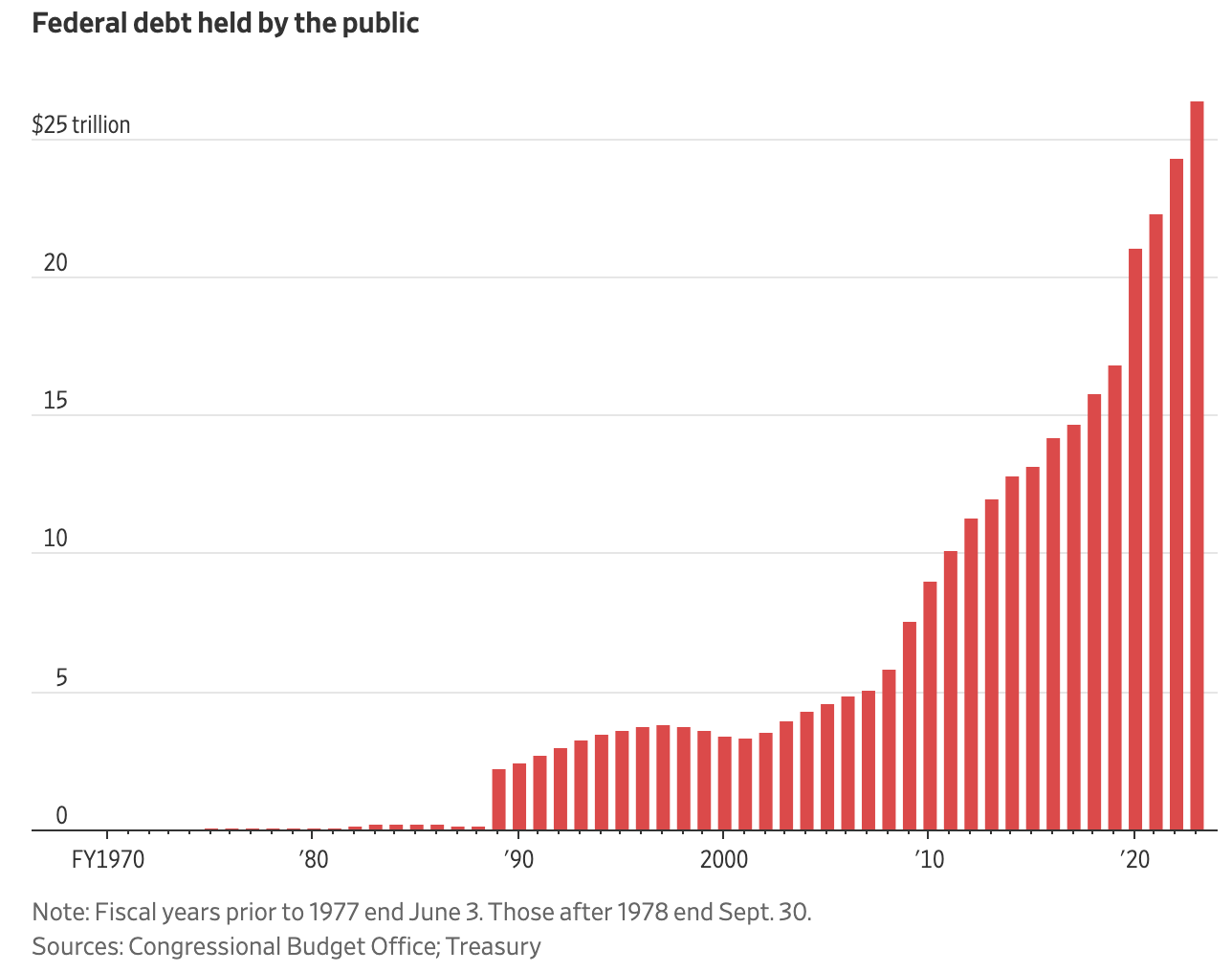

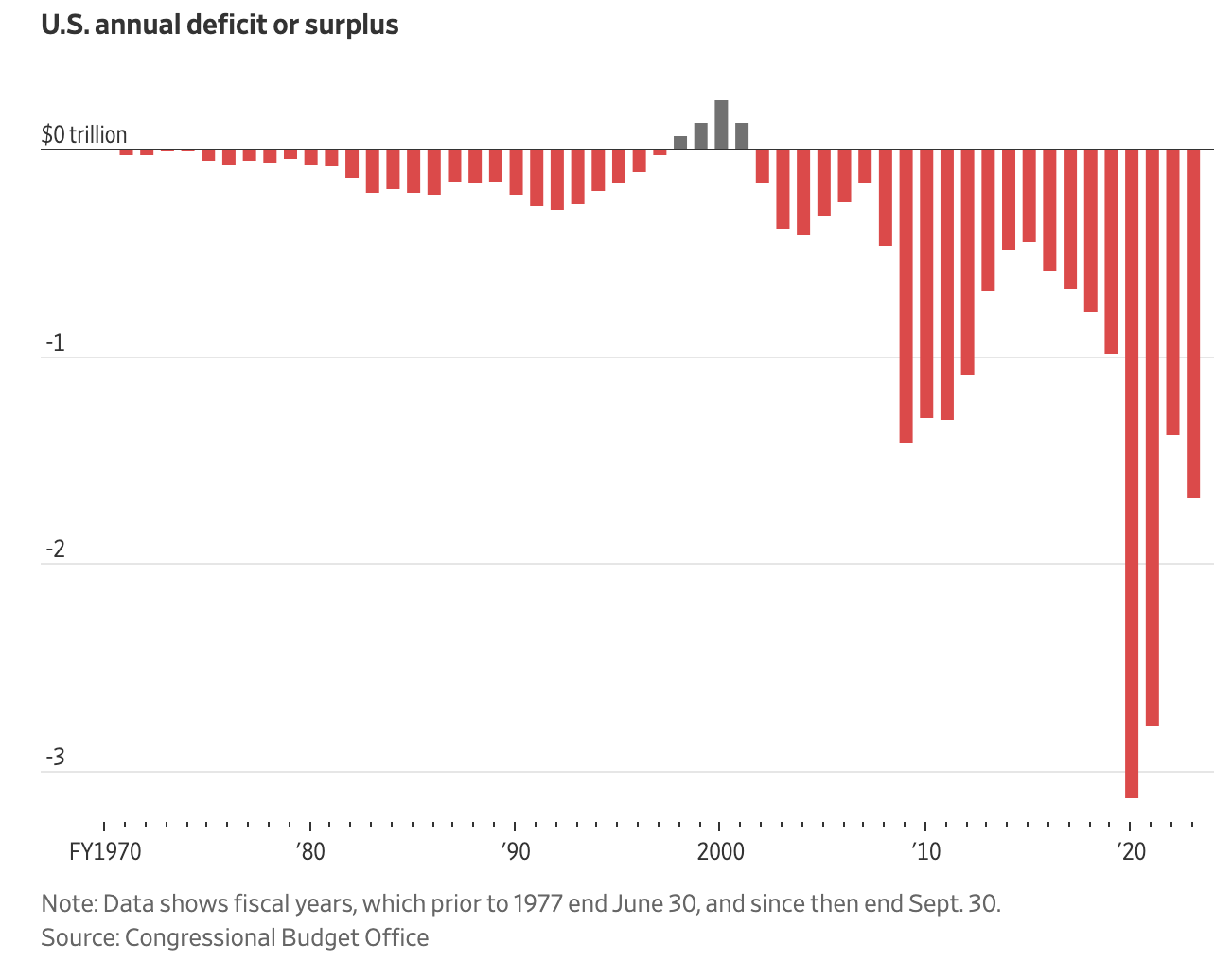

The FY2023 deficit is bad and only getting worse. Today, the Wall Street Journal sounded the alarm on skyrocketing year over year spending increases that are adding trillions of dollars to America’s already out-of-control debt and driving up interest rates. Two of the main culprits of our unsustainable deficits are lower tax revenues due to President Biden’s failed economic policies and higher interest expenses caused by Bidenomics.

Word on the Street (via Wall Street Journal):

- “The widening gap between spending and revenue is due to several factors, including lower tax receipts. Losses in the stock market in 2022 mean the Internal Revenue Service has experienced a drop in revenue from individual taxes that aren’t withheld from paychecks this year.”

- “At the same time, spending on Social Security, which is indexed to inflation, has increased, as has spending on Medicare and Medicaid."

- “Another important factor in the federal budget is higher interest rates, a result of the Federal Reserve’s effort to tame inflation.”

- “Higher Treasury yields increase the amount of money the federal government has to spend paying back its debt. Treasury yields filter into the government’s cost of borrowing gradually, as it rolls over debt issued previously at lower interest rates.”

- “More than half of all debt will mature in less than three years, meaning the government’s borrowing could keep costing more.”

The Big Picture

Eat, Sleep, Spend—that’s the Democrat agenda, and they won’t let the nation’s record debt crisis or anything else get in their way.

Democrats’ spending induced inflation continues to rage on and clocked in at a 3.7 percent year-over-year increase earlier today—prices are 3.7 percent higher today than they were a year ago, and 17.1 percent higher today than they were when President Biden took office, costing American families $1,261 more per year.

These high prices Americans are facing everywhere from the gas pump to the grocery store are a direct result of President Biden and the Democrats’ spending agenda.

And while inflation and interest rates remain elevated federal resources are drawn away from other important programs like border security, national defense, disaster relief and federal retirement programs. Further increases to interest rates would exacerbate deficits, stealing from Americans through future tax hikes or further inflation.

The Bottom Line

Enough is enough—Democrats have us locked in a vicious cycle of spending induced inflation and inflation induced interest rate hikes that increase spending and add to the debt.

House Budget Republicans have a plan to rein in incendiary spending, tame runaway deficits, and reduce interest costs. It’s time to “Reverse the Curse” and pass the committee’s Budget Resolution, before it’s too late.